Introduction

The healthcare payment landscape is rapidly transforming as patients demand digital solutions that provide ease, security, and flexibility.

A SecurityMetrics study highlights that maintaining compliance is a challenge for many merchants, with over half failing to meet PCI DSS requirements. Non-compliance can lead to costly penalties ranging from $5,000 to $100,000 per month, alongside heightened risks of security breaches.

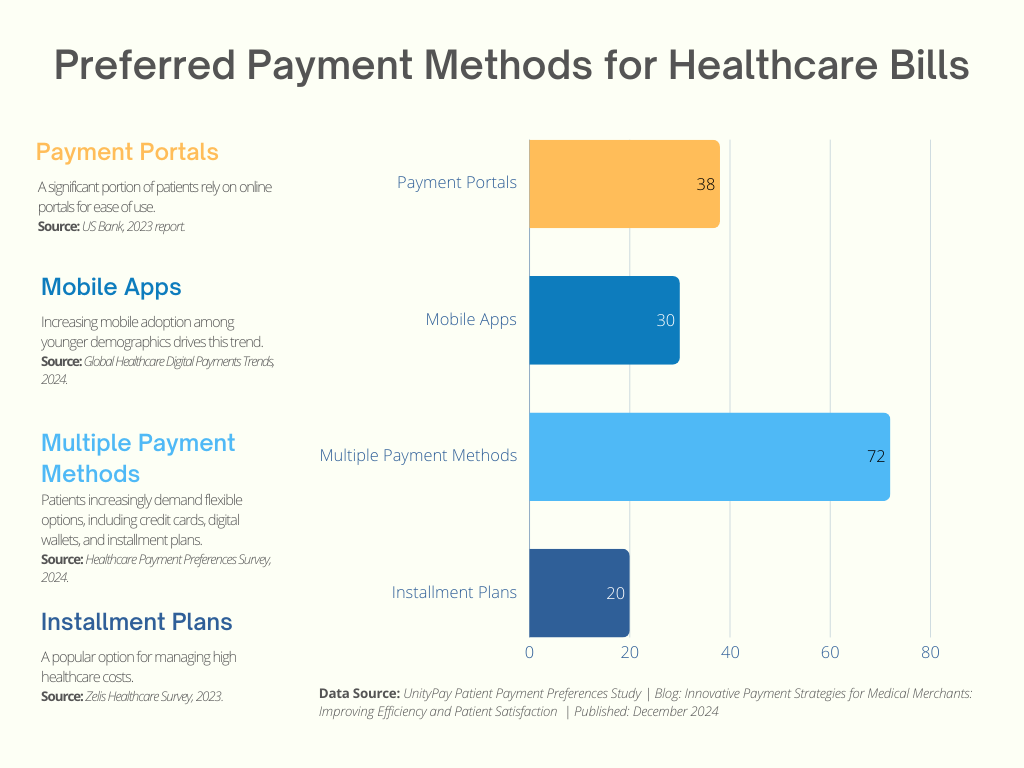

For medical merchants, prioritizing compliant and secure digital payment options not only mitigates these risks but also enhances patient satisfaction. Solutions like mobile apps and payment portals are now integral, as US Bank reports that 37% of patients prefer portals and 32% opt for mobile apps for bill payments.

With healthcare shifting towards patient-centric care, the payment experience has become an integral part of patient experience. Patients now expect healthcare providers to adapt to unique payment solutions that are seamless, transparent, and flexible payment processes which offer diverse payment solutions while they also protect their sensitive data.

Now, let’s dig a little deeper.

Understanding the Payment Needs of Patients

While reputation and quality of care are key factors in attracting new patients, accessibility and ease of service, especially regarding payments, are crucial for patient retention.

The financial side of healthcare is a key touchpoint for patients—Clear, flexible, and supportive payment options as they greatly enhance the experience and trust of a patient with a medical provider.

Rising Consumer Expectations:

Today’s patients expect convenience and transparency in every interaction, including payments. They value upfront cost estimates, easy-to-read invoices, and quick payment processes that fit their lifestyle.

Transparent and Flexible Payments:

Offering patients multiple ways to pay—such as credit cards, digital wallets, or payment plans—gives them control and reduces financial stress. This flexibility encourages prompt payments and improves satisfaction.

Financial Support and Payment Plans:

Payment plans help to alleviate the financial burden of high medical bills as it helps to pay the amount over time. If the providers are offering these payment plans, then patients will keep up with their payments, which would minimize bad debt and maximize satisfaction.

Digital Transformation in Medical Payments

The healthcare industry is adopting digital solutions to cater to the changing needs of patients and simplify financial transactions.

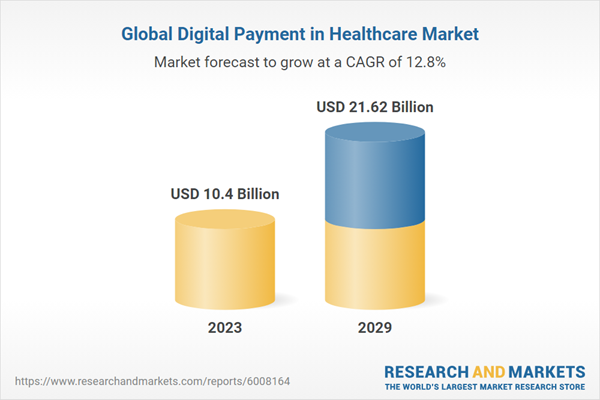

The Global Digital Payment market for healthcare was estimated to be worth USD 10.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 12.80% to reach USD 21.62 billion by 2029, according to Global Newswire.

The market is experiencing significant growth driven by the ongoing digital transformation within the healthcare industry.

Contactless payment, mobile wallets, and online portals have become the emerging trends helping patients to make secure and convenient transactions. Such options help minimize waiting times and make the patient experience even better.

Challenges Faced by Medical Merchants

Medical merchants navigate unique complexities in their payment processing operations, which can directly impact efficiency and cash flow. Key challenges include:

1. Regulatory Compliance

Adhering to healthcare-specific regulations such as PCI DSS and HIPAA demands rigorous attention to data security protocols and privacy laws. The U.S. Department of Health and Human Services can impose penalties of up to $50,000 per violation (with a maximum of $1.5 million annually for violations of the same type). Businesses not complying with PCI DSS can face fines that range from $5,000 to $100,000 per month, depending on the severity of the violation and the merchant’s volume of card transactions

2. Data Security Risks

Sensitive patient and financial data make medical merchants prime targets for cyberattacks. A single breach can lead to significant financial loss, operational downtime, and loss of patient trust.

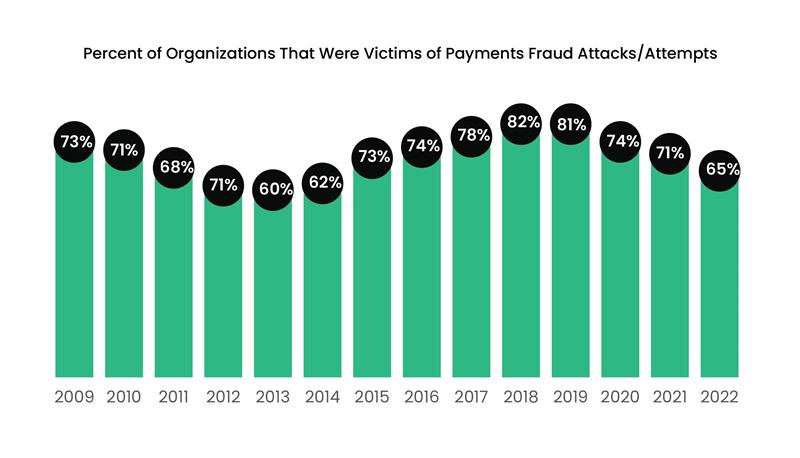

According to the 2023 Payments Fraud and Control Report by the Association for Financial Professionals and J.P. Morgan —65% of organisations reported attempted or real payments fraud in 2022.

Automated Clearing House (ACH) products and paper checks are among the most targeted types of payments. Check fraud has increased significantly since the start of the COVID-19 pandemic.

3. Complex Billing Workflows

Managing a mix of insurance payments, co-pays, and patient billing is a time-intensive process. Errors or delays in reconciliation can disrupt cash flow and require additional administrative resources to resolve.

According to the recent Becker’s Hospital Review, it is estimated that 80% of medical bills in the US contain errors.

4. Reputation at Stake

Data breaches are more than financial hits—they erode customer trust. According to Michael Edwards, a single breach can irreparably damage a company’s reputation, driving patients to more secure competitors.

5. High Transaction Costs

Payment processing fees, especially for credit card transactions, can strain budgets, particularly for smaller practices.

According to Zelis, the healthcare industry faces a projected 7% increase in operational costs in 2024, exacerbated by inflation, regulatory changes, and staffing challenges.

These rising expenses directly affect cash flow for medical merchants reliant on payment processing efficiency. Lack of transparency in fee structures adds to the financial burden.

By assessing the offerings before onboarding and integrating with a service provider that has transparent pricing models and tailored fee structures can directly contribute to better cashflow and lower stress on budgets.

6. Lack of Payment Options

According to a Healthcare Payments Survey, 70% of patients are more likely to pay if they can use multiple payment methods, such as instalment plans, ACH, or digital wallets, making it important for medical merchants to diversify their offerings.

Patients prefer multiple payment methods. Be it instalment plans, ACH, electronic medium. Consumers prioritize diversified offerings while they pick the care providers.

According to a 2023 survey, massive 91% of consumers prefer electronic payment methods for medical bills, while only 9% want to pay by paper check.

Patient-Centric Payment Solutions

Adopting a patient-focused approach to payments improves the overall healthcare experience. Modern solutions, such as self-service portals and text-to-pay systems, provide convenience and control to patients. According to a Healthcare Payments Survey, 70% of patients prefer having multiple payment options, including digital wallets, ACH transfers, and instalment plans.

In addition, 91% of patients favour electronic payment methods for medical bills, while only a small fraction—9%—opt for traditional checks. Offering diverse, flexible payment channels ensures fewer barriers in the payment process, ultimately enhancing patient satisfaction and loyalty.

Enhancing Security and Privacy in Healthcare Payments

Protecting patient financial data is critical for healthcare providers. A 2023 study found that 95% of healthcare organizations experienced a data breach in the past two years, underscoring the need for robust cybersecurity measures. To mitigate these risks, providers should implement:

- End-to-End Encryption: Ensuring that all payment data is secure during transmission and storage.

- Fraud Detection Tools: Real-time tools that flag suspicious activity and protect financial transactions.

Drata emphasizes that secure payment gateways and fraud detection systems play a pivotal role in achieving PCI DSS compliance while preserving patient trust.

UnityPay: Your Partner in Seamless Medical Payments

UnityPay addresses the unique challenges faced by medical merchants with tailored solutions:

- Regulatory Compliance: Advanced tools ensure adherence to PCI DSS and HIPAA, helping medical merchants stay ahead of evolving standards.

- Enhanced Security: End-to-end encryption and fraud detection tools safeguard sensitive patient information.

- Flexible Payment Options: UnityPay supports multiple payment channels—credit cards, mobile wallets, ACH transfers, and instalment plans—ensuring flexibility for patients and prompt collections for providers.

- Transparent Pricing: UnityPay offers clear, scalable pricing models to reduce transaction costs and improve cash flow management.

- 24/7 Support: Dedicated support ensures uninterrupted payment processing and troubleshooting assistance when needed.

By combining compliance, security, and operational efficiency, UnityPay empowers medical merchants to streamline their processes and deliver an enhanced payment experience.

Conclusion

Adopting innovative payment strategies is no longer optional for medical merchants—it’s essential for improving operational efficiency and ensuring a positive patient experience. By implementing patient-centric payment solutions, enhancing payment security, and offering flexible payment plans, healthcare providers can reduce operational inefficiencies while improving patient satisfaction. Partnering with UnityPay provides the tools necessary to achieve these goals, offering streamlined, secure, and scalable payment processing solutions that meet the unique needs of the healthcare industry.