Introduction

According to Forbes, CareCredit had 12 million cardholders and 270,000 participating providers in 2024, up from 4.4 million cardholders and 177,000 participating providers a decade prior, according to a May 2023 report by the Consumer Finance Protection Bureau (CFPB). This surge highlights the growing reliance on credit cards for medical expenses, as patients seek flexible ways to manage rising healthcare costs.

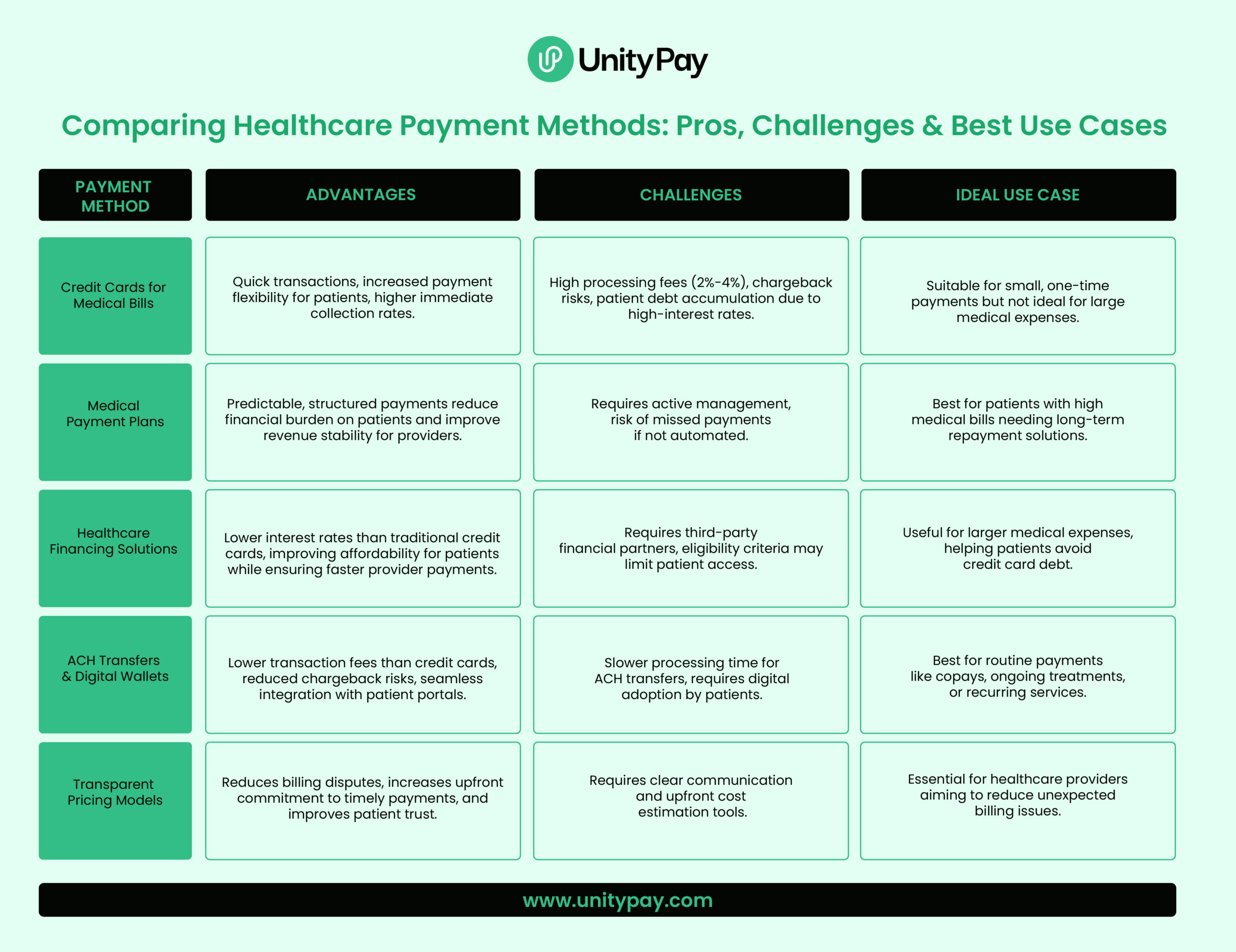

For healthcare providers, this trend presents both opportunities and challenges. While credit card payments offer quick transactions and improved cash flow, they also introduce high transaction fees, chargebacks, and payment disputes, which can disrupt revenue cycles and increase administrative burdens. As financial pressures pile up, providers must assess the impact of credit card payments for medical bills and consider alternative medical payment options that offer greater payment flexibility without compromising revenue integrity.

In this blog, we explore the impact of credit cards in medical billing, examining both their advantages and challenges for healthcare providers. We will also discuss alternative payment strategies that enhance financial stability while ensuring a seamless payment experience.

By leveraging modern medical merchant payment services and advanced payment solutions like UnityPay, providers can optimize revenue cycles and improve overall payment efficiency.

The Growing Burden of Medical Bills for Providers

Healthcare organizations are seeing an increase in medical debt, making payment collection more difficult. Several factors contribute to this financial strain:

Approximately 41% of adults in the United States have healthcare debt, including debt accumulated on credit cards for medical expenses. Among those with past-due medical bills, 24% use credit cards to pay some or all of their balances. This reliance on credit often results in high-interest debt, impacting financial stability for both patients and providers.

To further discuss this, let’s examine the key factors contributing to the growing burden of medical bills for providers:

The Impact of Rising Medical Costs:

Increased medical costs continue to impose pressure on patients and providers, increasing the cases of out-of-pocket payments. With high-deductible health plans (HDHPs) as well as gaps in coverage, many patients lack the financial ability to afford medical services, often delaying payment or opting for credit-based alternatives.

Delayed payments for healthcare providers mean longer revenue cycles, increased collection efforts, and more financial risk. If patients are unable to pay, providers must devote more resources to payment recovery, which raises operational costs and administrative burdens. This challenge points to the need for proactive payment strategies that promote timely and manageable medical bill payments.

Increased Credit Card Dependency:

Most of the medical bills are paid by credit card as a last resort to pay bills, and this increasing dependency poses financial risks for patients and providers alike. While instantaneous payments do come with a high processing fee to healthcare providers that takes a slice out of the providers’ bottom lines.

Further, chargebacks and payment disputes can lead to instabilities in revenue. An entity’s providers may face reimbursement delays as a patient may dispute the medical charges or result in potential loss of revenue.

Furthermore, administrative staff have to engage a long period in addressing chargeback claims, which increases operational inefficiencies. Therefore, such risks may be shielded by healthcare-specific payment solutions designed to minimize credit card dependence while also providing flexible and secure payment options.

Unpredictable cash flow:

Patients defer payments when they are financially unable to pay for services. Such deferrals can cause disruptions in revenue cycles, making it hard for healthcare providers to cover their operational expenses such as payroll, medical supplies, and facility costs. Fluctuating cash flow can also impact a provider’s ability to invest in technology upgrades, patient care improvements, or expansion efforts.

To counteract these issues, providers must implement structured payment solutions that encourage timely payments while minimizing administrative burdens. Flexible medical payment plans, automated billing solutions, and alternative payment methods can help stabilize cash flow while reducing the financial strain on both patients and healthcare organizations.

Partnering with merchant services like UnityPay, can help streamline payment collection and reduce reliance on credit cards.

Credit Cards: A Convenient but Costly Solution

Benefits of Accepting Credit Cards

Quick payments:

Credit cards enable instant payments, ensuring that providers receive funds quickly and reducing delays in revenue collection. This helps healthcare facilities maintain consistent cash flow, allowing them to cover operational expenses without relying heavily on follow-ups for unpaid balances.

Increased Payment Flexibility:

Many patients struggle with large medical bills upfront, making credit cards an appealing option. By allowing patients to spread out their expenses through their credit lines, providers can ensure that financial constraints do not delay necessary treatments. This flexibility improves access to care while reducing the likelihood of unpaid bills.

Higher collection rates:

Accepting healthcare credit cards increases the probability of on-time payments, as patients may prioritize their medical expenses when using credit. By offering multiple payment options, providers can encourage patients to settle their balances sooner, reducing the risk of long-term delinquencies and unpaid accounts.

Challenges of Credit Card Payments

While credit cards offer convenience, they come with financial drawbacks that impact provider revenue:

High Processing Fees:

Credti card transactions come with merchant fees that typically range between 2% and 4% per transaction. These costs directly cut into a provider’s revenue, especially for high-value medical procesdure. Over time, excessive processing fees can accumulate, significantly reducing profit margins.

Chargebacks and Disputes:

Unlike cash payments or direct bank transfers, credit card transactions are susceptible to chargebacks, where patiens dispute payments with their card issues. Whether due to billing confusion, dissatisfaction, or financial hardship, these disputes often result in lost revenue and increased administrative work to resolve them.

Long-Term Debt for Patients:

Many patients use credit cards for medical expenses without considering the long-term impact of high-interest rates. When balances aren’t paid off quickly, medical costs accumulate additional interest, leading to greater defaults, further complicating collection efforts for healthcare providers.

The high-interest rates on credit cards for medical expenses can lead to financial strain, increasing the risk of default on payments.

Merchant Service Provider like UnityPay offers tailored solutions that reduce the burden of credit card transaction fees while ensuring seamless and secure medical payment processing.

The Need for Payment Diversification

Although credit cards for medical expenses are widely used, they should not be the only payment method available. Healthcare payment processing solutions recommend offering a mix of medical payment plans, ACH transfers, and digital wallets to reduce reliance on credit cards and improve financial stability.

Tools like UnityPay provides tailored solutions to help healthcare providers optimize their payment strategies, minimizing transaction costs while maintaining seamless medical bill payment processing.

Alternatives to Credit Cards: Strengthening Payment Strategies

Medical Payment Plans

Offering structured medical payment plans allows patients to pay off balances over time without the burden of high-interest credit card debt. Providers can set up payment plans for hospital bills with predictable installment schedules, ensuring a steady revenue stream.

Healthcare-Specific Financing Solutions

Instead of relying on standard credit cards for medical expenses, providers can partner with healthcare payment processing companies that offer lower-interest patient financing programs. These specialized financing solutions provide structured repayment terms, increasing affordability and reducing medical debt accumulation.

ACH Transfers and Digital Payment Solutions

By implementing ACH transfers and mobile payment options, providers can accept medical bill payments directly from patient bank accounts, reducing processing fees and minimizing payment delays.

UnityPay facilitates secure ACH transactions, helping providers lower costs and improve payment efficiency.

Transparent Pricing Models

A clear pricing structure helps prevent surprise bills, leading to better patient financial planning and improved collection rates. When patients understand costs upfront, they are more likely to commit to a structured medical bill payment plan rather than relying on high-interest healthcare credit cards.

How Technology Enhances Payment Efficiency

Modernizing medical merchant services with digital payment solutions can streamline financial transactions and reduce administrative burdens.

Online Payment Portals

Secure online payment portals provide a convenient way for patients to settle medical bills, integrating multiple payment methods such as ACH transfers, medical payment plans, and credit card payments while offering transparency in billing. Payment Processing Solutions that offer customized payment portals that simplify transactions and improve collection rates.

Automated Payment Plans

By implementing automated payment scheduling, providers can reduce late or missed payments while improving revenue predictability. Automated systems send reminders, process recurring payments, and minimize administrative workload. Payment Processor that supports automated billing solutions, helping providers manage payments more efficiently.

Mobile and Contactless Payments

The adoption of mobile payment options allows patients to make payments through digital wallets, ensuring seamless transactions and reducing paperwork for providers. By leveraging medical merchant services and integrating modern payment technology, providers can enhance payment flexibility while ensuring financial stability.

UnityPay’s integration with mobile payment platforms enhances payment flexibility and convenience.

Bottom Line

While credit cards for medical bills provide an accessible payment method, they are not always the most financially sustainable option for healthcare providers. High transaction fees, chargebacks, and delayed payments present challenges that can impact the revenue cycle.

By incorporating medical payment plans, patient financing solutions, and digital payment portals, providers can create flexible payment options that reduce dependence on credit cards while improving cash flow.

Investing in transparent pricing and modern payment processing solutions ensures a more efficient and patient-friendly billing experience. Healthcare providers that adopt innovative medical payment options will strengthen their financial position while delivering a more accessible and reliable payment experience.

In an evolving financial landscape, embracing payment flexibility and technology-driven medical merchant services is essential for maintaining profitability and improving the overall medical billing process.

UnityPay can be a strategic partner in this transformation, offering secure, efficient, and cost-effective healthcare payment processing solutions.

FAQ's

What happens if a patient disputes a credit card charge for medical services?

When a patient disputes a charge (chargeback), the provider must submit evidence of the service provided and payment authorization. If unsuccessful, the provider may lose the revenue and face additional fees.

How can providers reduce credit card processing fees?

Providers can negotiate lower rates with healthcare merchant services, encourage alternative payment methods like ACH payments, and partner with cost-effective healthcare payment processing companies like UnityPay.

What security measures should healthcare providers take when accepting credit card payments?

To protect patient data, providers should comply with PCI DSS (Payment Card Industry Data Security Standard), use secure payment gateways, and implement tokenization or encryption for transactions.

Do digital wallets and contactless payments benefit healthcare providers?

Yes, digital wallets offer faster transactions, enhanced security, and lower chargeback risks compared to credit cards. They also improve payment flexibility for tech-savvy patients.

What is the difference between healthcare credit cards and regular credit cards?

Healthcare credit cards are designed specifically for medical expenses and may offer promotional financing, such as interest-free periods. Regular credit cards have higher interest rates and broader spending options.

Are healthcare providers required to accept credit card payments?

No, but offering credit card payments increases accessibility for patients. Providers can choose alternative medical payment options, such as ACH transfers, medical payment plans, and healthcare financing.