The Importance of Understanding B2B Payments in Today's Business Landscape

With billions flowing between businesses daily, today’s competitive world calls for a stronger way that helps companies to handle B2B Payments that can streamline their growth.

Let’s dive into why mastering B2B Payments is essential for keeping your business both agile and resilient.

Understanding B2B (Business-to-Business) payments is crucial for ensuring smooth operations and health cash flow. These transactions are the backbone of inter-business commerce, impacting everything from supplier relationships to operational efficiency. With the rise of digital payment solutions, navigating the complexities of B2B payments has become more essential than ever.

What exactly are B2B Payments and Why do they matter?

At the core of every business relationship lies a simple but vital question: How will we exchange value?

B2B payments are the answer.

These transactions power the intricate web of partnerships, contracts, and supply chains that keep businesses thriving.

Here’s a closer look at what defines B2B Payments- and why getting them right is pivotal-

B2B payments refer to the financial transactions that occur between businesses for goods or services rendered. Unlike B2C (Business-to- Consumer) Payments, which involve individual consumers, B2B transactions are typically larger in volume and value. They encompass a range of payment methods, including electronic funds transfers, checks, and credit card payments.

Why Optimizing B2B Payments is important to transform your bottom line?

Imagine being able to unlock hidden incomes and improve relationships just by rethinking your payment methods.

Optimized B2B payments don’t just make transactions smoother- they have the potential to impact every corner of your business.

From reducing costs to enhancing security, here’s why refining your B2B payment processes is worth the investment-

According to a report, digital and virtual payment methods, especially virtual cards, are gaining momentum and are expected to grow over 250% by 2028. These methods provide enhanced security, reduced fraud risk, and greater transaction efficiency, with 80% of U.S. B2B transactions projected to be digital by 2025.

Navigating the Challenges in B2B Payments

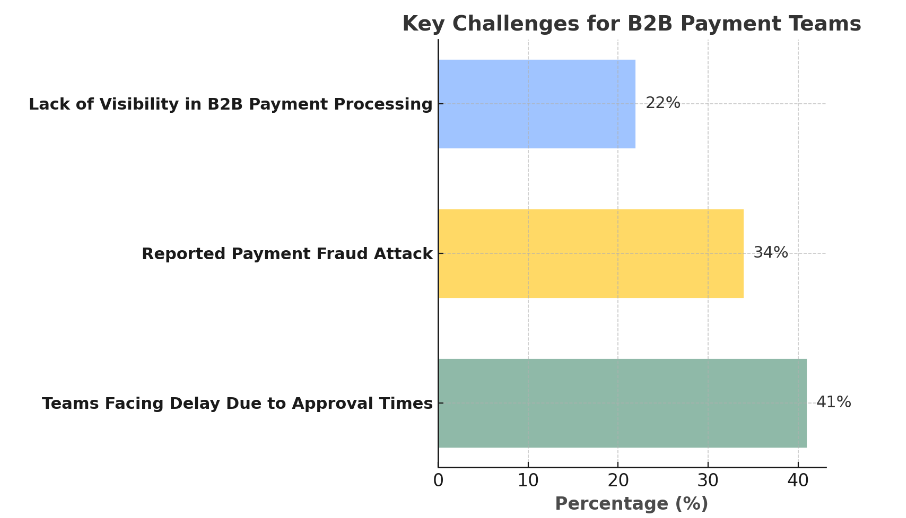

From delayed transactions to security threats, B2B payments come with a unique set of challenges that can drain time, energy, and resources. In fact, nearly half of all B2B payment teams report issues with processing delays, and payment fraud is a rising concern.

Let’s break down these hurdles and why they’re critical to address in a modern business landscape.

1. Delayed Transactions:

As per a recent report 41% of all B2B payment teams stated that they face delay in transactions due to lengthy approval times.

Delayed transactions can result from manual processing, slow approval workflows, and inefficient payment methods. Such hold-ups can strain supplier relationships and affect payment a business’s ability to meet its operational needs.

When suppliers are left waiting for payments beyond agreed terms, it can result in tension and even impact future partnerships. Internally, delayed transactions affect a business’s operational efficiency by disrupting cash flow, creating challenges in paying vendors and employees on time. This mismanagement can force companies to rely on credit, further increasing operational costs.

2. Payment Fraud Risk

Ardent Partners research found that 34% of businesses reported a business payment fraud attack over the past year. The entire P2P process is susceptible to fraud, making robust prevention technology essential.

For example, schemes like invoice fraud—where fake or duplicate invoices trick companies into unauthorized payments—and business email compromise (BEC)—where fraudsters impersonate vendors or executives—are common threats.

These attacks can lead to severe financial losses, reputational damage, and operational disruptions, as investigations delay payments and burden internal resources. Despite increasing awareness, companies relying on manual payment processes remain vulnerable to attacks like check fraud and unauthorized access to payment systems.

Uncover the essential compliance factors that could put a strain on your budget and disrupt your financial resilience.

3. Lack of Visibility into Payment Data

A lack of visibility into B2B payment processing activity is the third most significant challenge for AP teams (22%) and a major problem for treasury and finance teams, too. This hinders strategic decision-making, potentially leading to financial losses, inefficiencies, and strained relationships.

Limited visibility also increases the chance of duplicate payments, overlooked invoices, and payment errors, all of which can lead to unnecessary costs. Furthermore, a lack of transparency can strain vendor relationships, as suppliers are often left in the dark about when they will be paid. These miscommunications can escalate to disputes, impacting the company’s credibility and ability to negotiate favourable terms.

This fragmented view prevents finance teams from making timely decisions, such as adjusting working capital or forecasting cash needs accurately.

4. High Transaction Fees:

High transaction fees can pose a significant challenge for businesses, especially those dealing with frequent or large transactions. Payment methods like credit cards, while offering convenience and speed, often come with considerable costs. These fees can accumulate over time, cutting into a business’s profit margins and making it difficult to maintain financial stability.

For businesses that rely heavily on credit card payments B2B transactions, these recurring fees can become a substantial burden, impacting overall profitability. Additionally, unpredictable fee structures can complicate budgeting and financial planning.

To mitigate these challenges, choosing alternative methods such as ACH or wire transfers can help reduce expenses and optimize cash flow management.

Types of Payment Methods

- ACH Transfers: B2B ACH (Automated Clearing House) transfers are low-cost options for domestic payments, typically costing around $0.50 per transaction. They are suitable for regular payments, such as payroll and vendor invoices.

- Credit Cards: While B2B credit card processing provides quick transaction capabilities, they come with higher fees. Businesses often face transaction fees of 2% to 4%, making them less ideal for large payments but useful for smaller, immediate purchases.

- Wire Transfers: B2B Wire transfers are ideal for large, urgent payments, especially in international transactions. However, they can incur significant fees and are less commonly used for routine payments due to cost.

Interest: Why These Methods Matter?

Selecting the right payment methods can lead to significant operational efficiencies. Here’s why they matter:

- Operational Efficiency: Optimized payment methods reduce delays, enhancing vendor relations and ensuring timely delivery of goods and services. Faster payments foster goodwill among suppliers, which can lead to better terms and conditions.

- Cost Management: By understanding and choosing the most cost-effective payment methods, businesses can improve their profitability. Companies can save substantial amounts by switching from credit card payments to ACH transfers, for example.

Key Levels of Payment Processing

B2B transactions are comparatively less frequent than B2C transactions even though they involve large volumes or large-ticket products or services. Due to this nature, card networks have a separate category of interchange for corporate, business or commercial purchase cards, which employs much lower interchange rates.

Card networks expect that businesses are met with certain requirements. If not met, transactions become downgraded and charged with a higher interchange fee.

This is where Level 2 and Level 3 data processing comes into picture. Different requirements are expected with each data processing level. Higher the level, more are the requirements. However, higher the level, lower the processing fees.

Below is a quick breakdown of the different processing levels:

Processing Level | Applicable for | Data Captured | Use Case | Benefits |

Level 1 | B2C Transactions or simple B2B payments | Basic cardholder data (name, card number, expirations date) | Small businesses with straightforward payment needs | Standard interchange rates (higher fees compared to Level 2 and Level 3) |

Level 2 | Medium- sized Businesses making corporate or government payments | Level 1 data + tax amount, customer code, and merchant postal code | B2B Transactions requiring additional transparency for tax and accounting | Lower interchange fees compared to Level 1 processing |

Level 3 | Large enterprises, government contractors, or high- value transactions | Level 2 data + detailed line items (product descriptions, quantities, freight costs) | Complex B2B transactions needing precise tracking for reporting and compliance | Lowest interchange rates, enhanced visibility, better fraud prevention |

Required data for Level 2 Card Processing:

- Merchant Name and Category Code

- Billing Zip Code

- Purchase: Amount, Date and Order Number

- Customer Code

- Destination: State, City, Address, Zip

- Invoice number

- Merchant Tax Identification Number (TIN)

- Sales Tax Amount and Indicator

Required data for Level 3 Card Processing:

- All Level 2 Data

- Commodity Code

- Country Code Destination

- Debit/Credit Indicator

- Duty/ Import Taxes Assessed

- Extended Price

- Freight/ Shipping Cost

- Item ID and Description

- Line Discount

- Unity of Measure (each), Price and Quantity

- VAT Information/ reference number

Key Features of Effective B2B Payment Solutions

To successfully navigate the challenges of B2B Payments, businesses should look for solutions with the following key features:

Automation:

Automating payment processes helps streamline operations by eliminating manual errors and accelerating transaction times. Manual payment workflows, such as invoice entry or approval routing, are prone to mistakes that can lead to delays, duplicate payments, or missed deadlines.

Automation ensures greater accuracy by standardizing these processes and reducing human involvement in routine tasks. Additionally, automated systems allow for faster approvals and seamless data flow between departments, improving cash flow and operational efficiency.

Beyond speed and accuracy, automation provides real-time visibility into payment statuses, helping businesses make better financial decisions. Adopting automation creates a more scalable and reliable payment infrastructure, crucial for handling business growth.

Security:

Security is critical in financial transactions, especially for B2B payments, where large sums and sensitive data are involved. Effective payment solutions should adhere to PCI Compliance standards and employ advanced fraud detection tools to safeguard information. Prioritizing security helps businesses prevent financial losses, avoid data breaches, and build trust with vendors and partners, ensuring smooth and reliable transactions.

In addition to PCI Compliance, advanced solutions often include encryption, multi-factor authentication, and tokenization to protect payment data at every stage. Pro-active monitoring tools can detect suspicious activities in real-time, preventing fraud before it occurs.

By investing in advanced security measures, businesses not only reduce risks but also ensure long-term compliance with evolving regulations, fostering stronger vendor partnerships.

Transparent Fees:

Choosing payment solutions with clear pricing structures helps avoid hidden costs, enabling businesses to manage their budgets effectively. Understanding the fee structure can help businesses make informed decisions about payment methods.

Transparent pricing is essential for businesses to manage their finances effectively and avoid unexpected costs. Payment solutions with clear fee structures allow companies to understand exactly what they are paying for, whether it’s transaction fees, currency conversion charges, or processing costs. This clarity empowers businesses to choose the most cost-effective payment methods and plan their budgets accurately.

Hidden fees can erode profits over time, so selecting providers that offer upfront, predictable pricing ensures there are no surprises down the line. With transparent fees, companies can also compare providers more easily and negotiate better terms. Ultimately, this fosters financial stability and enables businesses to optimize cash flow

ERP Integration:

A payment solution that integrates seamlessly with existing Enterprise Resource Planning (ERP) systems streamlines the reconciliation process, significantly reducing the administrative burden associated with manual data entry. By automating the transfer of payment data directly into the ERP, businesses can enhance accuracy, minimize errors, and save valuable time.

Seamless ERP integration is crucial for companies looking to improve operational efficiency and financial management. This integration allows finance teams to focus on strategic tasks rather than getting bogged down in repetitive manual processes. By connecting payment solutions directly with ERP systems, businesses gain real-time access to financial data, improving visibility and enabling informed decision making.

Furthermore, integrating payment solutions reduces the risk of discrepancies and data errors, enhancing overall financial integrity. As a result, organizations can quickly adapt of agility and responsiveness.

What Unity Pay Offers to be the Right Partner for B2B Payments

UnityPay offers a secure, compliant, and fast payment processing solution, tailored to businesses that need next-day funding, seamless device compatibility, and industry-leading data protection.”

Here’s a what we offer:

Comprehensive Payment Options:

UnityPay supports a wide array of payment methods, including:

- ACH Transfers

- Credit Cards

- Wire Transfers

This diverse range allows businesses to select the payment solutions that best align with their operational needs and customer preferences. By offering multiple payment options, we enable businesses to enhance their cash flow management, improve vendor relations, and ensure transactions can be completed efficiently and effectively.

Automated Processes:

Our solutions are designed to automate payment processes, significantly reducing manual intervention and the potential for human error. Automation leads to faster transaction times, enabling businesses to process payments quickly and efficiently.

This not only enhances operational efficiency but also allows finance teams to focus on strategic initiatives rather than tedious administrative tasks. By streamlining payment workflows, Unity Pay helps businesses improve productivity and achieve a more organized financial operation.

Security Focus:

We prioritize the security of your financial transactions. Our solutions are built with high- security standards, including PCI Compliance and advanced fraud detection systems.

Our advanced systems encompass:

- Fraud Detection Tools

- Tokenization

- Vaulting

By employing these features, we help businesses in safeguarding sensitive payment information from potential threats. With emphasis on the security, businesses can leverage mitigating risks associated with data breaches and fraud, instilling confidence in both the organization and its customers that their financial transactions are safe and secure.

Flexible Integration:

Our payment solutions are designed to integrate seamlessly with your existing ERP and accounting platforms. This flexibility simplifies the payment process, ensuring that data flows smoothly between systems without the need for manual entry.

By improving data accuracy and reducing the administrative burden, our integrations enhance overall operational efficiency. Businesses can make use of real-time access to financial information, facilitating better decision-making and strategic planning while ensuring that their payment processes align perfectly with their existing workflows.

Success Stories/ Testimonials:

Conclusion

Optimizing B2B payments isn’t just about speed or convenience—it’s a transformative step toward securing the future of your business.

Uncover how Unity Pay can help simplify complex payment processes, enhance cash flow, and protect your transactions with industry leading security regulations.

Ready to elevate your payment strategy? Let’s get it started today.