Introduction

In 2023, healthcare providers faced an estimated $26 billion in uncollected patient payments, largely due to inefficient billing processes and delayed reimbursements.

As patients shoulder a growing share of medical expenses, nearly half the struggle to manage their bills, amplifying financial challenges for providers.

Additionally, regulations like the No Surprises Act (NSA) demand upfront cost transparency to protect patients from unexpected charges, increasing complexity to compliance efforts. Addressing these issues with modern payment solutions can streamline workflows, enhance patient trust, and ensure financial stability for healthcare providers.

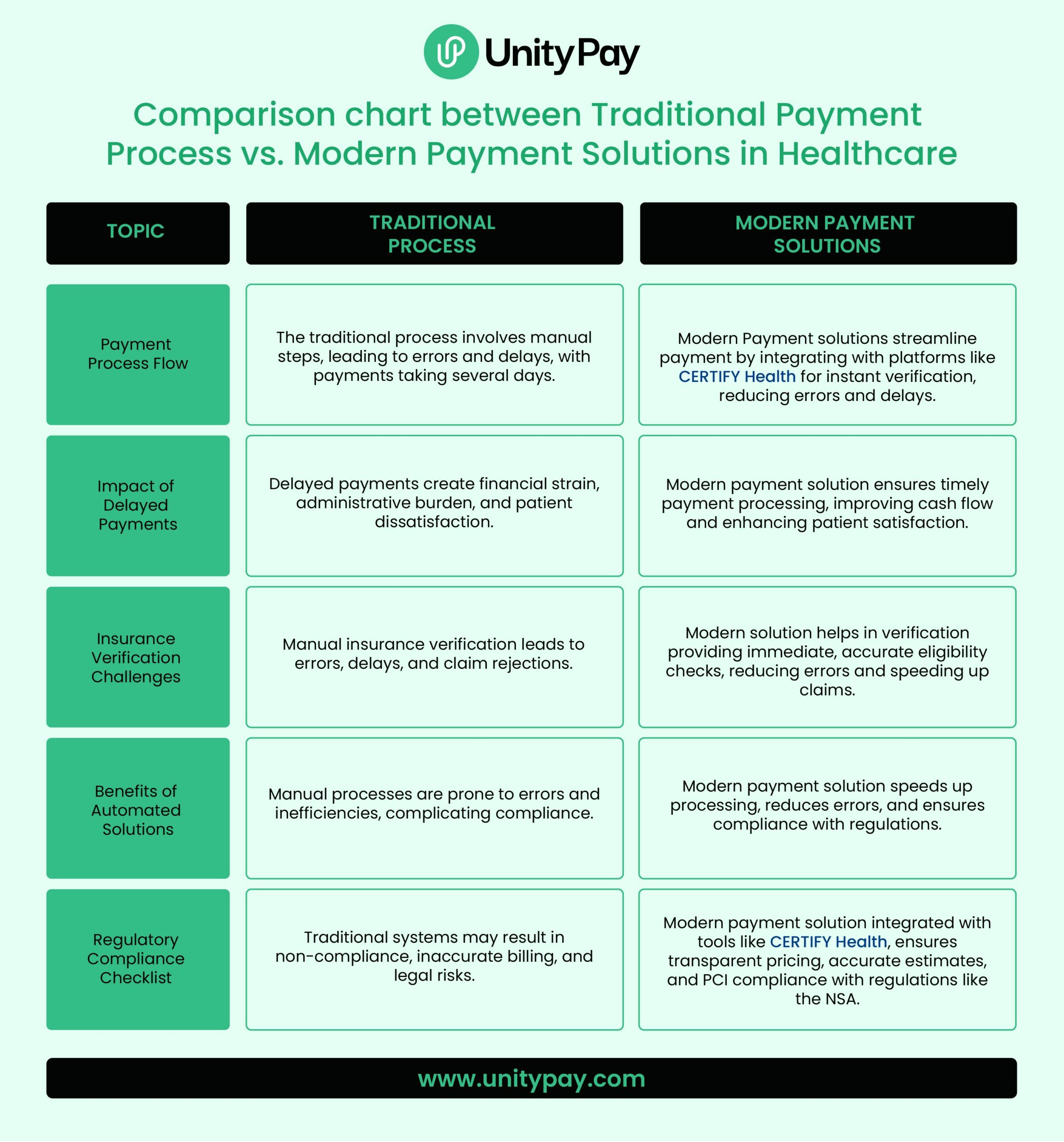

This blog delves into the inefficiencies and challenges of traditional healthcare payment systems, including compliance with the No Surprises Act, billing errors, and delayed reimbursements. It also highlights modern payment solutions that enhance efficiency, ensure regulatory adherence, and improve patient satisfaction through secure, transparent systems.

Inefficiencies in Healthcare Payment Processes

Delayed Healthcare Payment Process

The complexities of manual billing systems and high-volume transactions often lead to delayed payment collections. Lengthy claim submission processes, coupled with frequent denials and resubmissions, create repetitive cycle that frustrates both providers and patients.

These delays impose financial strain on healthcare providers, limiting cash flow and hindering operational efficiency. Additionally, the inability to provide accurate and transparent billing further diminishes patient trust and satisfaction. Resolvign these inefficiencies is crucial for healthcare practices to maintain stability and improve the overall care experiences.

Errors in Insurance Verification

According to American Institute of Healthcare Professionals, up to 20% of initial claims contain insurance eligibility errors.

Insurance verification errors remain a significant challenge for healthcare providers, particularly when managing high volumes of verifications. Manual verification efforts are prone to inaccuracies and inefficiencies, especially under pressure from tight schedules and complex insurance requirements.

Relying on external insurance verification service providers can also introduce delays and inconsistencies, aggravating the issue. These verification errors frequently lead to clain rejections and delayed reimbursements, inflating administrative costs and straining patient provider relationships. Addressing these inefficiencies is essential to improving financial and operational outcomes.

Insurance Eligibility Verification solutions like CERTIFY Health helps in streamlining insurance verification with automated process reducing these errors. By improving accuracy and efficiency, healthcare providers can enhance both their billing cycle and patient experience.

Compliance and Regulatory Challenges

Navigating regulatory frameworks like No Surprises Act (NSA) is a dauting taks for healthcare providers. Failure to meet its stringent requirements, such as providing upfront cost estimates for out-of-network services, can lead to fines up to $10,000 per violation and significant reputational damage.

Similarly, the rising threat of cybercrime and the need to PCI Compliance highlight the importance of robust payment data security. Non-compliance exposes providers to data breaches, legal penalties, and a loss of patient trust, impacting both operational efficiency and revenue.

These inefficiencies can no longer be overlooked. They create operational bottlenecks, delay payments, and ultimately result in lost revenue, heightened compliance risks, and unsatisfied patients.

Consequences of Outdated Systems

Outdated payment systems have far-reaching consequences that extend beyond administrative inefficiency and affect the overall financial health of healthcare practices.

Financial Strain

Manual processes often lead to increased administrative costs, which can be a significant drain on practice resources. Providers must spend more time on tasks such as correcting claim errors, verifying patient information, and chasing down delayed payments. These efforts not only slow down the payment cycle but also exacerbate financial instability. As collections are delayed, cash flow suffers, leaving practices with fewer resources to invest in staff, technology, or patient care. Over time, the lack of timely reimbursements can make it difficult to cover operating costs and grow the practice.

Patient Dissatisfaction

Patients who experience billing errors or receive unexpected medical bills due to poor insurance verification often feel frustrated and disengaged. A lack of transparency in pricing, billing errors, and slow payment processing can significantly impact patient trust.

Confusing billing processes and unexpected out-of-pocket costs erode trust and loyalty. Compliance with regulations like the No Surprises Act (NSA) becomes critical in addressing patient concerns over unexpected bills.

Tools like CERTIFY Health simplify compliance by providing transparent, upfront cost estimates during the intake. Features such as payment reminders, diverse collection options, and payment flexibility (including co-pay and insurance-based payments) streamline processes, boost satisfaction, and improve overall financial efficiency.

Operational Inefficiency (Errors in Insurance Verification)

Outdated systems place unnecessary burdens on staff, forcing them to juggle repetitive, manual tasks like verifying insurance details and correcting billing errors. This not only eats into their time but also shifts focus away from what truly matters—delivering quality patient care.

As a result, administrative workflows become bogged down, staff morale declines, and the practice’s overall productivity suffers.

It’s clear: embracing modern solutions isn’t just a luxury, it’s a necessity for improving operations and achieving better outcomes for both staff and patients.

How Can Healthcare Providers Overcome Payment Challenges?

Flexible Payment Options

Offering diverse payment methods, such as credit cards, ACH transfers, digital wallets, and recurring billing, ensures patients can choose their preferred method. The flexibility accelerates collections and reduces delays, contributing to improved cash flow.

Text-to-Pay Services

Simplifying payment collection with text-to-pay functionality enhances patient engagement. Sending secure payment links via SMS allows patients to pay conveniently from their devices. When combined with Insurance Verification and Pre-Registration solutions like CERTIFY Health, this integration ensures a cohesive and streamlined patient journey.

Adherence to Regulatory Compliances

Compliance with Payment Card Industry Data Security Standards (PCI DSS) is essential for safeguarding sensitive payment data. Implementing solutions like UnityPay that adhere to these standards minimizes the risk of breaches and builds long-term patient trust, vital for sustaining relationships.

Transparent Pricing

Transparent pricing builds trust with patients by minimizing billing confusion. Clear and easy-to-understand statements foster confidence and reduce disputes, ensuring a smoother payment experience for both providers and patients.

By integrating advanced tools and focusing on secure, patient-friendly systems, healthcare providers can effectively mitigate payment challenges and streamline their operations.

Key Takeaway

Healthcare providers face growing demands to modernize their payment processes.

By offering flexible payment methods, text-to-pay capabilities, PCI DSS Compliance, and transparent billing, UnityPay streamlines operations, accelerates cash flow, and enhances patient satisfaction.

Additionally, when integrated with tools like CERTIFY Health, which supports pre-registration and cost transparency, UnityPay creates a comprehensive solution for healthcare providers. Together, these technologies optimize workflows, improve regulatory compliance, and ensure a seamless and secure patient payment experience.

Take the first step toward modernizing your payment processes with UnityPay today, ensuring a seamless, patient-friendly, and secure payment experience.

FAQ's

How can automated insurance verification improve payment eligibility checks?

Automated systems minimize errors by instantly validating insurance details, ensuring accurate eligibility checks, and reducing claim rejections.

What are the advantages of advanced payment solutions in healthcare?

Advanced solutions offer secure, transparent, and flexible payment options, enhancing cash flow and compliance with regulations like the NSA.

How can healthcare providers ensure accurate payment eligibility for patients?

By integrating automated verification tools, providers can quickly determine coverage and cost-sharing details, preventing billing errors and delays.

How do health payment systems address NSA compliance?

Modern systems provide tools for transparent cost estimates and upfront communication, ensuring compliance with the NSA and avoiding legal risks.