In 2024, over 80% of customers prioritized speed and security over traditional payment methods when dining out (National Restaurant Association). As digital payments dominate, restaurants face a critical question: Are you ready for 2025?

Customer expectations in 2025 for seamless and secure payment options in restaurants are higher than ever, driven by a significant shift towards digital payments and heightened awareness of security issues. According to the National Restaurant Association’s latest reports, diners increasingly prioritize speed and convenience when making payments, making it essential for restaurants to implement efficient, secure, and cost-effective payment solutions to stay competitive.

This guide will explore key strategies for streamlining restaurant payment processing, helping you reduce friction for both staff and customers while maintaining the highest levels of payment security compliance.”

Why Payment Processing Matters for Restaurant Success

Common Payment Processing Challenges in Restaurants

Payment system downtime can severely disrupt restaurant operations and diminish customer satisfaction.

For instance, a 2023 Square outage U.S. merchants unable to process electronic payments for hours, compelling a shift to cash transactions. This incident resulted in immediate revenue losses and eroded customer trust.

Furthermore, research by Nilton Gomes Furtado and colleagues indicates that unreliable payment systems can lead to customer dissatisfaction, potentially driving patrons to competitors.

These instances highlight the critical need for dependable payment processing systems to ensure seamless operations and maintain customer loyalty

System Downtime and Reliability Issue:

Restaurants often encounter payment interruptions, impacting operations and customer satisfaction. Outages or technical issues with POS payment processing systems, especially during peak hours, can cause disruptions.

Payment interruptions affect customer satisfaction and can lead to loss of revenue, especially during peak hours.

High Transaction Fees:

Transaction fees can accumulate quickly, impacting a restaurant’s profit margins.

According to National Restaurant Association, transaction fees cost restaurant owners $77.5 billion in 2021. For a restaurant with annual revenues of $500,000, a 2% transaction fee amounts to $10,000, which can significantly impact profit margins.

These charges are often tied to the volume of transactions and can add up over time, leaving restaurants with a sizable portion of their revenue going to processing fees.

Typical Costs from Major Credit Card Companies

| Credit Card | Average Interchange Fees | Average Assessment Fees |

| Visa | 1.15% plus 5 cents to 2.40% plus 10 cents | 0.14% |

| Mastercard | 1.15% plus 5 cents to 2.50% plus 10 cents | 0.1375% (transactions under $1,000); 0.01% (transactions $1,000 or more) |

| Discover | 1.35% plus 5 cents to 2.40% plus 10 cents | 0.13% |

| American Express | 1.43% plus 10 cents to 3.30% plus 10 cents | 0.15% |

Source: Forbes Credit Card Processing Fees (2024 Guide)

According to Forbes, the average card processing fee was between 1.5%-3.5% in 2023. Considering this, even a small markup on credit card fees can greatly impact on profit margins.

Security Concerns:

With the rise in cybercrime, it’s critical to ensure your payment systems are secure. A data breach could hurt your restaurant’s reputation and lead to significant financial penalties. Seeking a provider that prioritizes security with regular audits and encrypted transactions can minimize these risks.

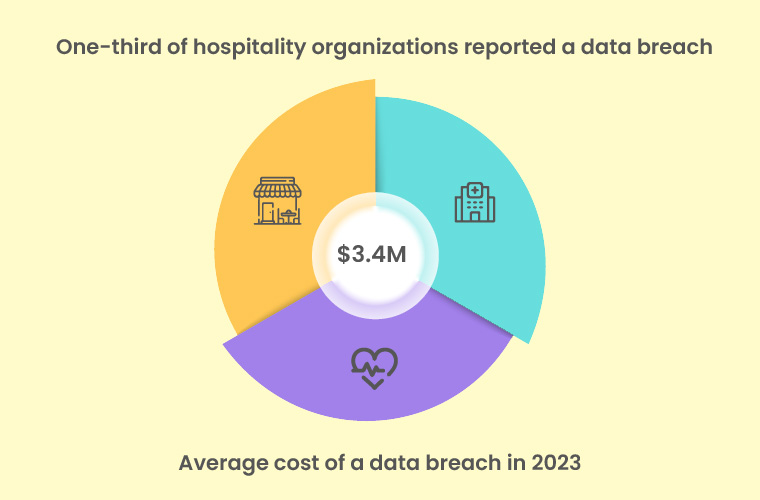

According to a report published by Trustwave, almost one-third of hospitality organisations have reported a data breach in their company’s history, with average cost of a breach at around $3.4 million in 2023.

Customer Experience:

Slow, complicated, or unreliable payment systems can frustrate customers, potentially leading them to choose competitors for their next dining experience. A smooth and fast payment process is essential for customer satisfaction, reducing wait times, and enhancing repeat business.

Exploring Payment Method Options for Restaurants

Traditional and Emerging Payment Types

- Credit and Debit Cards: The most traditional method of payment, credit and debit cards remain popular among restaurant-goers. Restaurants that accept credit cards ensure convenience and flexibility for customers while benefiting from increased sales, through robust payment systems. To maintain customer trust, investing in secure and reliable systems for restaurant credit card processing is essential, especially during peak hours.

- Mobile Wallets: Mobile wallets such as Apple Pay and Google Pay are increasingly popular among tech-savvy customers for their security and ease of use. Restaurants with contactless payment options provide a fast and efficient way to make payments, helping reduce wait times and improve customer satisfaction.

- Contactless Payments in Restaurants: From NFC cards to wearable payment devices, contactless payments are fast becoming a preferred option for their speed and ease of use. Especially QR codes and Online Payment Links as they have become growing trends post COVID-19 for safe and efficient payments.

Choosing the Right Payment Processor for Your Restaurant

Selecting the right payment processor is a foundational step in optimizing your restaurant’s payment operations. Here are some key factors to consider:

- Reliability and Security as Non- Negotiables: Reliability and data security are essential, especially for high-volume business. Unreliable processors can lead to disruptions during peak times, while weak security leaves business vulnerable to data breaches. A provider that prioritizes security and has a strong track record ensures stability for your operations.

- Cost and Fee Transparency: Payment processing fees and other hidden costs can quickly impact your budget. It’s essential to fully understand each provider’s fee structure, including processing fees, monthly fees, and any setup costs. Consider providers who offer straightforward, cost-effective pricing to help you manage your budget.

- Support and Integration with Existing Systems: Ensuring compatibility with your restaurant’s existing POS payment processing systems and software is essential for smooth operations. Choosing a provider who offers ongoing support to streamline implementation and solve issues quickly, so you can avoid operational disruptions and receive assistance when you need it most.

Leveraging Point of Sale (POS) Systems for Efficient Restaurant Payment Processing

POS systems are the central hub for processing payments in your restaurant. Modern POS payment processing solutions not only streamline payment transactions but also help manage inventory, track sales data, and enhance customer service.

A reliable Point of Sale (POS) system is a critical component in modern restaurant payment processing, enabling more efficient and flexible operations.

Here are some key aspects to consider:

- Mobile Compatibility for Flexibility: With mobile POS payment processing capabilities, restaurants can bring the payment process directly to customers, whether they’re seated, in a drive-through, or at a pop-up location. Mobile compatibility offers flexibility and speeds up transaction times, enhancing the overall dining experience.

- Seamless Integration with Restaurant Management Tools: Modern POS payment processing systems are designed to integrate smoothly with various management tools, streamlining operations. By linking the POS processing with inventory, customer loyalty programs, and accounting software, restaurants can efficiently manage stock levels, track customer preferences, and automate financial reporting. These integrated systems not only save time but also provide valuable insights to help managers make informed business decisions.

Prioritizing Security and Compliance in Payment Solutions

As more restaurants adopt digital payment solutions, security is a critical concern. Payment security is about more than just protecting customer data; it also ensures your business complies with industry regulations and avoids costly penalties.

According to a 2023 report by Trustwave, nearly 31% of hospitality organizations have experienced a data breach, with the average cost of such incidents around $3.4 million. This underscores the critical importance of adhering to PCI DSS compliance and implementing end-to-end encryption to safeguard sensitive payment information.

Securing payment data is essential to protect both your business and your customers.

Here are some key components to consider:

- Importance of Tokenization and Encryption: Tokenization and encryption are foundational to secure payment processing. Look for solutions that implement cutting-edge security features, such as PCI DSS (Payment Card Industry Data Security Standard) and PCI P2PE (Point-to-Point Encryption) compliance, as a baseline for safety. These standards are designed to protect sensitive cardholder information, ensuring that data is encrypted during the entire transaction process, minimizing the risk of data breaches.

- Regular Security Audits and Employee Training: Consistent security checks and a well-trained team are critical in maintaining a secure environment. Choose providers that conduct regular security audits to ensure compliance with evolving security standards. Implement staff training to familiarize employees with safe handling of payments and recognizing potential security threats. This proactive approach helps mitigate risks and ensures that everyone is vigilant in maintaining data security.

Unity Pay’s Approach to Payment Processing for Restaurants

At Unity Pay, we understand the challenges in providing secure, fast, and flexible payment solutions for restaurants merchants. That’s why we’ve designed our payment processing systems to address these key needs.

Unity Pay offers comprehensive solutions tailored to meet the unique needs of restaurants, focusing on efficiency, security, and scalability.

- Streamlined Payment System Integration: Unity Pay integrates smoothly with POS systems, ensuring that all transactions are processed seamlessly across in-house and online orders.

- Transparent and Cost-Effective Pricing: We offer flexible, transparent pricing structures, allowing restaurants to save on transaction fees and avoid hidden costs.

- Security and Compliance: With advanced encryption and fraud prevention tools, Unity Pay prioritizes data security to protect both restaurants and customers.

- Flexible Payment Methods: Unity Pay supports a wide range of payment options, including credit/debit cards, mobile wallets, and contactless payments, enhancing customer convenience.

- Scalability for Future Growth: Our solutions are built to grow with your business, allowing for easy expansion and the adoption of new technologies as needed.

- Backup Systems: We ensure business continuity with backup systems that reduce downtime during outages, allowing operations to continue smoothly. (Unity Pay’s integration reduced downtime by 40% for our Restaurant partners, enhancing customer satisfaction scores by 15%.)

- Transparency with Customers: Unity Pay offers clear transaction information to help restaurants build trust and transparency with customers.

Bottomline

As we move into 2025, investing in the right payment processing solutions will ensure your restaurant remains competitive, secure and prepared for the future.

By selecting a reliable, cost-effective, and secure payment processor like Unity Pay, you can streamline your payment processing, improve customer satisfaction, and protect your business against potential security threats.

Stay ahead of the curve and make sure your payment systems are ready for what the future brings.