Did you know that according to a recent study, 60% of small businesses close within six months of a cyber attack? It’s a harsh reality that highlights just how vulnerable businesses can be.

With the rapid growth of online payment systems, businesses are more exposed than ever to security threats that can damage their operations and customer trust. It’s essential to prioritize PCI compliance- not just for the sake of payment security compliance itself, but as a cornerstone for building customer relationships and ensuring smooth business operations.

Unfortunately, many businesses still underestimate the significance of rigorous payment security standards. They often assume that basic measures are enough, overlooking the critical role security plays in protecting their payment systems.

Payment security compliance goes beyond just avoiding PCI Compliance penalties and legal issues; it’s about safeguarding customer data and protecting against the increasing numbers of data breaches and digital threats.

In this article, we’ll discuss the critical importance of payment security compliance, the potential risks and consequences businesses face when they fail to comply, and what solutions- including PCI DSS Compliance, P2PE PCI Compliance also known as PCI P2PE encryption, and ETA membership- can help businesses stay secured. We’ll also be covering what these standards are and why businesses need to choose the right payment partner to remain compliant.

Introduction: The Digital Economy and the Rise of Payment Security Threats

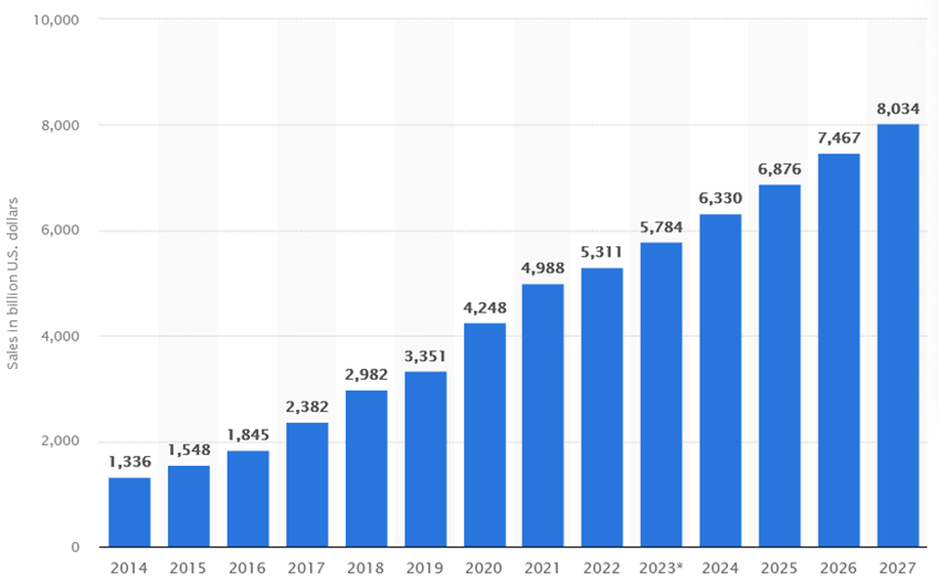

According to a report by Statista, global e-commerce sales reached nearly $5 Trillion in 2023, and these numbers are predicted to grow gradually.

Source: Statista Report Image https://www.statista.com/statistics/379046/worldwide-retail-e-commerce-sales

As businesses handle increasing volumes of transactions, the need for advanced payment security has become crucial. Unfortunately, cybercrime have evolved along with these technological advancements, constantly seeking ways to exploit vulnerabilities in payment systems.

The global economy, over the past two decades, has undergone a great change towards digitization, with E-commerce, Mobile Payments, and Contactless Transactions becoming the new standard. This massive change has brought about many opportunities for businesses, offering the with the new ways to reach customers and streamline operations. However, this shift has come with a new set of obstacles- particularly in terms of payment security.

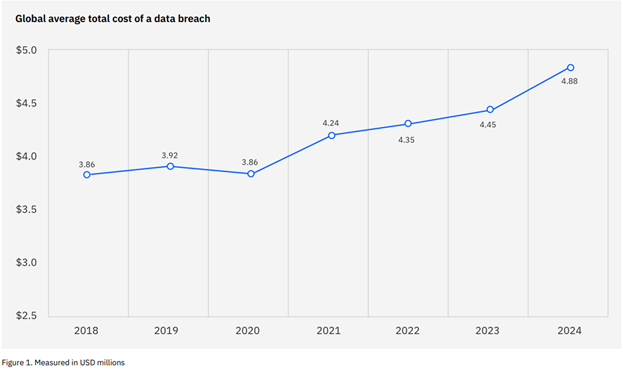

The IBM 2024 Cost of a Data Breach Report estimated the global average cost of a data breached to be around $4.88 million- an amount that can cripple a small business or case significant financial strain on larger enterprises as well.

Data breaches have become alarmingly common, with millions of records compromised every year. These breaches not only cause financial loss but also result in long- lasting damage to brand reputation.

Businesses that fail to prioritize compliance risk falling victim to costly breaches, operational disruptions, and regulatory penalties. Hence, adopting a proactive approach to payment security compliance is crucial to mitigating risk and building a sustainable business.

Problems Faced by Businesses without Payment Security Compliance

Payment Security Compliance is a comprehensive framework that protects both your business and the customers from a wide range of risks. Many businesses, particularly small and medium- sized enterprises (SMEs), often neglect or under-invest in their payment security infrastructure. This results in a host of problems that can prove devastating both financially and operationally.

1. Increased Risk of Data Breaches:

Source: IBM’s Data Breach Report for 2024.

According to a report from IBM, The cost of data breaches hit an all-time high of US$ 4.88 million in 2024 – 10% increase from over last year and at the all-time highest ever. Businesses are exposed to a higher risk of cyberattacks, including data breaches if failed to comply with payment security standards. When essential security protocols, such as encryption and regular monitoring, are ignored, hackers can hackers can easily infiltrate systems and steal information such as credit card numbers, customer details and transaction histories.

This further leads to identity theft, which is not only damaging for the customers affected but also for your business itself which impacts the reputation of the business.

Now, let’s talk about reputation damage caused by a data breach.

2. Reputation Damage:

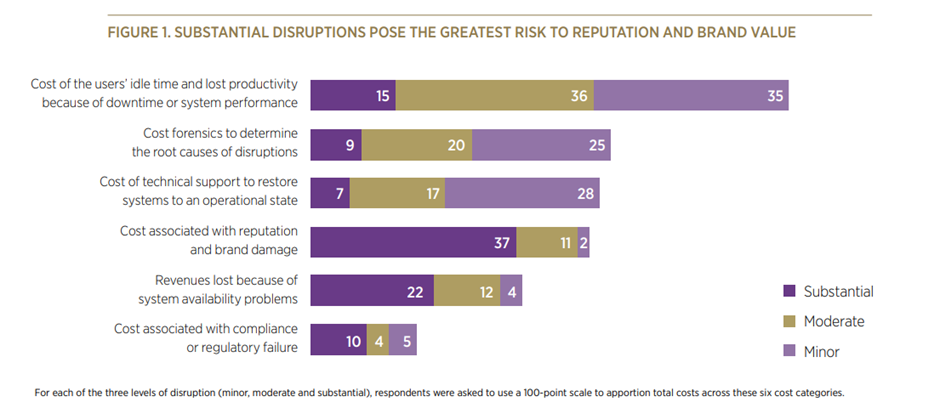

Source: Forbes Insights https://images.forbes.com/forbesinsights/StudyPDFs/IBM_Reputational_IT_Risk_REPORT.pdf

A single breach of data can completely wipe out your years of hard work in building your brand and customer loyalty. When customers entrust business with their payment information, they expect it to be kept secured.

But when there is a breach, it not only undermines that trust but also sends a message that the business is negligent in protecting customer data. All of a sudden, customers may feel that your business in negligent in safeguarding their information, and that’s a tough pill to swallow.

As per a study conducted by Forbes back in 2013, 46% of the businesses were hit with reputation damage due cybersecurity data breach.

Some of the major areas of risks when reputation is impacted due to data breach are as follows:

- Cost of the users’ idle time and lost productivity because of downtime or system performance Cost forensics to determine the root causes of disruptions

- Cost of technical support to restore systems to an operational state

- Cost associated with reputation and brand damage

- Revenues lost because of system availability problems

- Cost associated with compliance or regulatory failure

3. Financial Penalties and Legal Action:

What are the risks of not following Payment Security Standards? Well, the risks are high.

Regulatory bodies and industry organizations, such as Payment Card Industry Security Standards Council (PCI SSC), enforce strict compliance requirements for businesses that handle cardholder data. Non-compliance can result in steep fines, particularly if a data breach occurs.

According to PCI security compliance regulations non-compliance leads to hefty monthly fines ranging from $5000 to $100,000.

Businesses that fail to comply with these standards face significant PCI DSS non-compliance penalties- especially due to breach. The last thing you want is to navigate the aftermath of a breach and the costly consequences that follow.

4. Operational Disruption:

A data breach doesn’t just impact a company’s finances- it can disrupt your daily operations as well.

After a breach, businesses often need to redirect internal resources to investigate the incident, contain damage, and implement new security measures. This can lead to considerable downtime, particularly for businesses may have to undergo audits.

The impact doesn’t stop there; it can ripple through third-party vendors and partners.

Many businesses are part of interconnected networks. When one part of that network is compromised, it can have a dropping effect for everyone involved.

Potential Risks for Businesses Without Payment Security Compliance

I know for a fact that overlooking payment security compliance is a gamble no business should take. While the immediate issues are already concerning, it’s the long- term consequences that’s truly worrisome.

Major consequences are as follows:

1. Lawsuits and Regulatory Scrutiny:

Lawsuits related to data breaches are becoming increasingly common, particularly as consumers become more aware of their rights to data protection under laws like the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States. These laws grant individuals the right to seek compensation in the event their data is mishandled or exposed.

Failure of adherence with payment security regulations can lead to increased scrutiny from regulatory bodies, causing further audits and investigations. The costs of legal defence, settlements, and regulatory PCI DSS penalty can easily exceed the initial investment in security compliance, making non- compliance a costly gamble.

2. Lost Customers and Revenue:

Today’s consumers are more informed than ever about the risks tied to data breaches, and they’re becoming increasingly selective about where they spend their money.

After a data breach, even the most loyal customers may decide to take their business elsewhere, leading to leading to a sharp decline in revenue. When customers hear about a data breach, their first thought is often about their personal information and whether it’s safe. Trust plays a vital role in customer loyalty.

Moreover, negative experiences spread quickly on social media, potentially deterring new customers from even considering your business. In a competitive market, losing customers over a security lapse not only impacts immediate revenue but also has a long- lasting effects in your brand reputation and customers’ base.

PWC’s 2024 Global Data Trust Insights reveals that data breaches of more than $1 million affected a significantly greater share of businesses between 2023 and 2024 — from 27% to 36%

3. Industry Blacklisting:

Non-compliant businesses may find themselves blacklisted by payment processors and card networks, which can immensely affect their ability to conduct transactions. Payment processors are responsible for ensuring that the businesses they work with comply with security standards like PCI DSS.

If a business fails to meet these standards, the payment processor may refuse to continue processing transactions on their behalf, effectively cutting off the business from a vital revenue system.

Being blacklisted can be particularly damaging for e-commerce businesses, which rely on digital payment processing to function. Without the ability to process credit card transactions, these businesses are left with few alternatives, forcing them to either shut down or drastically scale back to operations.

Customers may view a blacklisted business as untrustworthy, making recovery and rebuilding a challenging task that takes significant time and effort.

What are- PCI-DSS, PCI P2PE, and ETA Membership?

To fully understand how Unity Pay can help your business achieve payment security compliance, it’s important to delve into the specifics of each of these standards.

For a clearer picture, let’s explore on each of these compliance standards:

1. PCI-DSS (Payment Card Industry Data Security Standard)

The Payment Card Industry Data Security Standard (PCI-DSS) is a set of security standards designed to ensure that businesses securely process, store, and transmit cardholder data. Established by the PCI Security Standards Council (PCI SSC), the standard applies to all entities involved in payment card transactions, including merchants, payment processors, and service providers.

PCI-DSS is comprised of 12 high-level requirements, each of which addresses a specific aspect of payment security:

1. Install and maintain a firewall- to protect cardholder data.

2. Do not use vendor-supplied defaults- for passwords and other security parameters.

3. Protect stored cardholder data.

4. Encrypt transmission of cardholder data- across open, public networks.

5. Use and regularly update anti-virus software.

6. Develop and maintain secure systems and applications.

7. Restrict access to cardholder data- by business need-to-know.

8. Assign a unique ID to each person- with computer access.

9. Restrict physical access to cardholder data.

10. Track and monitor all access- to network resources and cardholder data.

11. Regularly test security systems and processes.

12. Maintain a policy that addresses information security- for all personnel.

PCI Compliance is mandatory for any business that accepts payment cards, and non-compliance can result in steep penalties, ranging from fines to suspension of payment processing capabilities.

2. PCI P2PE (Point-to-Point Encryption)

PCI P2PE is an encryption standard developed by the PCI SSC that ensures that sensitive payment card information is protected throughout the transaction process. P2PE PCI Compliance encrypts payment data at the point of interaction (such as a card terminal) and ensures that it remains encrypted until it reaches the payment processor. This reduces the risk of data being intercepted by cybercriminals during the transaction.

One of the key benefits of P2PE Compliance is that it helps businesses reduce their PCI-DSS compliance scope, as the payment data is encrypted and unreadable to anyone who intercepts it. This makes it easier for businesses to achieve PCI-DSS compliance and reduces the cost and complexity of maintaining a secure payment environment.

3. ETA Membership

Why Choose Unity Pay?

How Unity Pay Ensures Payment Security Compliance

Unity Pay offers a comprehensive suite of merchant services across industries, ensuring secure and seamless payment solutions for every business type, which includes:

High- Risk Merchant Services (interlink) | Payment solutions for industries with higher chargeback risks. |

B2B Merchant Services (interlink) | Optimized processing for business-to-business payments. |

E-commerce Merchant Services (interlink) | Secure payments for online transactions. |

Retail Merchant Services (interlink) | Quick in-store payment solutions.

|

Restaurant Merchant Services (interlink) | Payments for dine-in, takeout and delivery. |

Medical Industry (interlink) | HIPPA- compliance payments for healthcare providers. |

We also ensure robust protection from the risks of non-compliance, including PCI DSS Compliance, PCI P2PE Encryption, and the benefits of ETA Membership.

By partnering with Unity Pay, businesses can:

- Ensure Compliance with PCI DSS, protecting cardholder data and reducing the risk of data breach.

- Secure Payment Transactions with PCI P2PE, ensuring that sensitive information remains encrypted throughout the entire transaction process.

- Stay ahead of the curve with access to the latest payment industry trends, insights, and best practices through ETA Membership.

In addition to these security features, Unit Pay offers a range of other benefits, including competitive pricing, seamless integration with existing systems, and 24/7 customer support.

Whether you’re a small business looking to improve your payment security or a large enterprise in need of a robust, scalable solution, Unit Pay has the tools and expertise to help you succeed.

Conclusion

To wrap it up, businesses must prioritize payment security compliance front and centre- not only to protect themselves from the financial and reputational damage caused by data breaches but also to build trust with customers and ensure long- term success. Unity Pay is here to help you navigate the complexities of payment security and compliance, providing you with the tools and support necessary to thrive today’s digital economy.

Ensure your business is protected with Unity Pay- because when it comes to payment security there’s no room for compromise.

Let’s connect to take a look at how your business can be optimized