Introduction

In retail, checkout isn’t just the final step—its’ a crucial moment that can determine whether a customer completes their purchase or leaves frustrated.

According to a study conducted by Baymard Institute, an average of 70.19% of online shopping carts are abandoned, often due to issues at checkout. This cart abandonment impacts not only immediate sales but also long- term customer satisfaction and brand reputation. Customers today expect a quick, secure, and seamless checkout experience, both in-store and online.

This blog explore why retailers should prioritize a secure and efficient checkout process to improve customer satisfaction, reduce abandonment rates, and drive revenue.

The Impact of Checkout Experience on Customer Satisfaction

Speed Matter:

A slow checkout process is one of the top reasons for cart abandonment. Customers, expect fast, hassle-free transactions—especially during peak hours.

For example, a major e-commerce site reduced its checkout time by just 3 seconds, leading to a 10% increase in completed sales.

Speed not only retains customers but also builds loyalty.

Security and Trust:

For today’s customers, security is paramount. With data breaches in the news, customers are wary about sharing their payment information.

According to a recent report by Security Magazine, 66% of consumers would not trust a company following a data breach.

Secure payment systems, which include encryption, tokenization, and PCI Compliance, build trust essential for repeat business.

Convenience:

With the rise of digital wallets and contactless payment options, customers favour retailers that offer flexible payment methods. Retailers who offer choices between traditional credit cards, Apple Pay, Google Pay, and others make it easier for customers to complete purchases quickly.

Common Retailers’ Challenges with Checkout Systems

Slow Processing Times:

A delay in processing payment information can frustrate customers and lead to cart abandonment.

For instance, a retailer that experiences even a 2 second delay in processing can see a noticeable drop in customer satisfaction and conversions. Especially during high-traffic events like holiday sales, a slow checkout process can leave customers feeling impatient and lead them to abandon their carts.

Fast processing systems are crucial, customers engaged and ensuring sales are completed, particularly during peak shopping times when patience is lower.

Security Vulnerabilities:

Many payment systems have outdated security protocols, exposing retailers to potential breaches.

According to a 2024 report by IBM, the average total cost of a data breach was $4.88 million—a 10% increase from 2023.

Beyond the direct financial costs, data breaches significantly damage customer trust, with many consumers hesitant to return after a breach. Investing in strong security measures and maintaining PCI compliance helps retailers safeguard sensitive data, protect customer loyalty, and avoid the long-term impact of reputational damage.

Outdated Technology:

Outdated checkout systems can severely impact the checkout experience, reducing customer satisfaction and affecting sales. Many retailers still rely on legacy systems that struggle to support modern payment systems like digital wallets and contactless payment options.

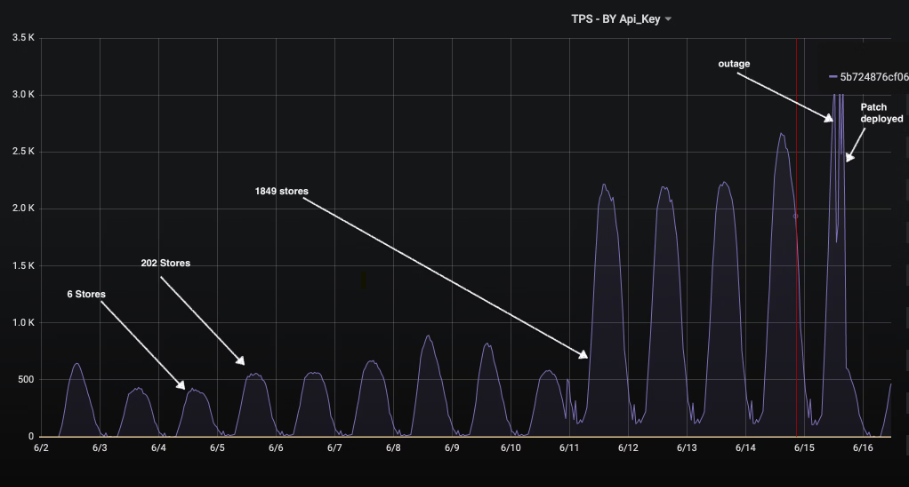

For example, in 2019, Target experienced a significant POS system outage that left customers unable to check out for hours, resulting in widespread frustration and potential revenue loss. This incident illustrates the risks of relying on aging technology that can’t keep up with today’s payment demands.

Benefits of a Secure and Efficient Checkout System

Prioritizing secure, efficient checkout systems provides both immediate and long-term benefits:

Increased Sales and Reduced Abandonment Rates:

A faster checkout process means fewer customers leave without completing their purchase.

A new study by BigCommerce’s proves that checkout experience increases revenue with a visit conversion rate of 20% higher than the market benchmark.

By focusing on an efficient checkout system, retailers can capture sales that would otherwise be lost.

Improved Customer Loyalty:

Secure and reliable checkout experiences foster trust, and customers are more likely to return.

According to fera.ai 66% of consumers stated many online reviews make them trust a brand online.

By providing a trustworthy checkout process, retailers can cultivate a loyal customer base that supports long-term growth.

Enhanced Reputation:

Retailers known for fast, secure checkout systems earn a valuable reputation in a competitive market. A positive checkout experience doesn’t just increase customer retention—it also drives word-of-mouth recommendations, as customers are more likely to share their seamless experiences with friends and family. This enhanced reputation can be a powerful differentiator, attracting new customers who prioritize reliable, secure payment systems in their shopping experience.

Best Practices for Improving Checkout Systems

Use Modern POS Systems:

Modern POS systems are faster, secure, and compatible with multiple payment methods. Consider POS systems with cloud capabilities for real-time updates and faster processing.

Implement Contactless and Mobile Payment Options:

Contactless payment options not only speed up the process but give customers flexibility, which encourages them to complete their purchase.

Ensure PCI Compliance:

Compliance with PCI standards i.e., PCI DSS and PCI P2PE, is essential for protecting customer data. Regular audits and security checks helps ensure systems meet industry standards, reducing the risks of breaches and instilling confidence.

Streamline the Checkout Process:

Simplifying checkout—by reducing unnecessary steps, allowing guest checkout, and limiting forms—makes the experience quicker and more user-friendly. Retailers who streamline checkout see a significant reduction in abandonment and an increase in satisfaction.

How UnityPay Can Help

UnityPay offers tailored solutions that address retailers‘ challenges in optimizing checkout systems:

- Fast Transaction Processing: UnityPay ensures rapid transaction speeds, reducing wait times and helping retailers retain customers, especially during peak hours.

- PCI Compliance and Security: Our commitment to PCI compliance means robust security measures that protect sensitive customer data, reinforcing trust and confidence.

- Multi-Channel Payment Options: UnityPay supports a wide range of payment methods, including contactless payment options, making the checkout experience smoother and more inclusive.

Bottom Line

Prioritizing secure and efficient checkout systems isn’t just a best practice—it’s essential for today’s retailers. Enhancing checkout speed, security, and convenience creates a shopping experience that keeps customers returning.

Ready to take your checkout to the next level? Start by reviewing your current setup and customer feedback and explore how UnityPay’s solutions can help streamline your checkout process for success.